By Chikumbutso Mtumodzi, Dowa

President Dr. Lazarus Chakwera’s call on the global north to consider writing off debts could be a kicker and a jewel in the crown for poor countries mainly in the global south as they quest to untangle themselves from unsustainable debts.

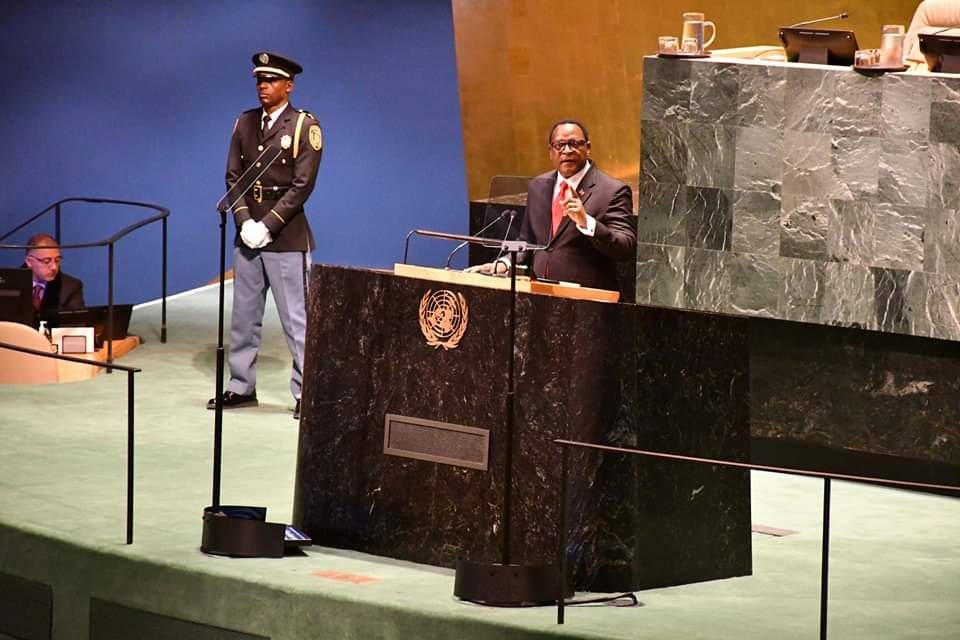

The President made the call for debt relief when he spoke on Thursday, September 21, 2033, at the ongoing United Nations General Assembly (UNGA) in New York, the United States.

In an emphatic speech, which stressed the need to promote a sustainable planet with equal opportunities, President Chakwera said there is an urgent need to fix the areas that hamper economic progress, particularly for poor countries like Malawi including unsustainable debts.

“Malawi is in distress because its debt is unsustainable, and so our call to action on behalf of all Least Developed Countries (LDCs) on this matter remains the same: Cancel the Debts! Cancel the Debts! Cancel the Debts!,” said President Chakwera.

He said Malawi has made progress on a number of areas in its quest towards attaining the empowering Vision 2023, but added that there is still a long way to go. He thus called for urgent support from various stakeholders to safeguard the progress made thus far.

“While we celebrate the progress we have made on these goals, with seven years to go before the end of the Decade of Action on SDGs, we are not satisfied with seeing progress on only five out of seventeen goals,” said President Chakwera.

Added President Chakwera: “Not only do we need support with making gains in the areas where we are seeing little, but we even need urgent support with safeguarding the gains we have made in the areas where we are doing well. In short, we need urgent support in building resilience to inoculate our economy against the adverse effects of shocks.”

President Lazarus Chakwera’s call for debt relief is a crucial step towards revitalizing Malawi’s economy. Malawi has been grappling with a high debt-to-GDP ratio, which has hindered its ability to finance development projects and achieve sustainable economic growth.

I highlight some reasons why debt relief is essential for Malawi’s economic growth:

1. Reduced Debt Service Costs: Malawi’s debt service costs are substantial, consuming a significant portion of the country’s budget. Since 2020, Malawi has been spending approximately 20% of its budget on debt service. By reducing the country’s debt burden, President Chakwera’s call for debt relief could free up resources for other development priorities, such as investing in infrastructure, education, and healthcare.

2. Increased Access to International Finance: Malawi’s high debt levels have made it challenging for the country to access international finance. With a reduced debt burden, Malawi could become more attractive to investors and access cheaper funding sources, which could help finance development projects and stimulate economic growth.

3. Improved Macroeconomic Stability: Malawi’s high debt levels have also contributed to macroeconomic instability, with the country experiencing frequent balance of payments challenges and exchange rate fluctuations. By reducing the country’s debt burden, President Chakwera’s call for debt relief could help stabilize the macroeconomic environment, which could attract more investment and promote economic growth.

4. Enhanced Investor Confidence: Debt relief could also enhance investor confidence in Malawi’s economy, as investors would be more likely to invest in a country with a lower debt burden. This could lead to increased foreign direct investment (FDI), which could help drive economic growth and create jobs.

5. Reduced Poverty and Inequality: By promoting economic growth and job creation, debt relief could help reduce poverty and inequality in Malawi. The country has made significant progress in reducing poverty in recent years, but there is still much work to be done. Debt relief could help accelerate this progress and improve the lives of millions of Malawians.

The IMF on board

The President’s address at UNGA came on the back of a staff level agreement that government of Malawi has reached with the International Monetary Fund (IMF) on the second and also the last review of the Staff Monitored Program with Executive Board Involvement (PMB).

This means Malawi is on a firm courses to receive about $174.00 million in a new 48-month financing arrangement under the Extended Credit Facility (ECF). The agreement is subject to IMF Management and Executive Board approval.

This agreement is a result of frantic negotiations by the two parties carried out over the past defined period. The IMF team was led by Ms. Mika Saito.

In her statement, Ms Saito said Malawi could access up to $174.00 million. “The IMF team has reached a staff-level agreement on the Second (and last) Review of Malawi’s Staff Monitored Program with Executive Board Involvement (PMB) , and macroeconomic and financial policies and reforms to be supported by an ECF arrangement,” she said.

She added that the successful approvals by the IMF Board of could open up doors for financing from other donors and creditors who have been waiting in the wings for Malawi to accomplish defined macro-economic factors.

Added Ms Saito: “Malawi is recovering from a series of shocks, including an outbreak of cholera and cyclone Freddy. Real GDP growth is projected to increase to 1.6 percent in 2023, with shortages of foreign exchange still weighing on economic activity. Inflation is expected to average 30.3 percent in 2023 and to decline to around 7 percent in the medium-term.”

Ms Saito commended the Malawi government for ramping up efforts to meet fiscal targets under the PMB plus adjusting expenditure to offset shortfalls in revenue, and containing government borrowing to slow money growth.

“The Reserve Bank of Malawi (RBM) tightened the monetary policy to contain inflationary pressures and resumed foreign exchange auctions. Rebuilding foreign reserves of the RBM has been slow as access to trade credit remains limited since the beginning of the year,” said Ms Saito in her statement.

She added that the program aims at restoring macroeconomic stability, building a foundation for inclusive and sustainable growth, addressing weaknesses in governance and institutions as well as strengthening resilience to climate-related shocks.

“Monetary policy will remain anchored on containing money growth. It will aim to tame inflation by ensuring positive real interest rates. The banking system remains stable though exposure to government securities needs to be closely monitored,” added the IMF team leader in her statement.

So many stakeholders, including Civil Society Organisations (CSOs) have recently come out to commend President Chakwera and government for implementing tight fiscal measures within an economic policy framework to stabilize the economy.

Just recently HRDC commended President Chakwera over the rapid infrastructure projects particularly the road network that is being constructed across the country.

The author is writing in his personal capacity