By Chisomo Phiri

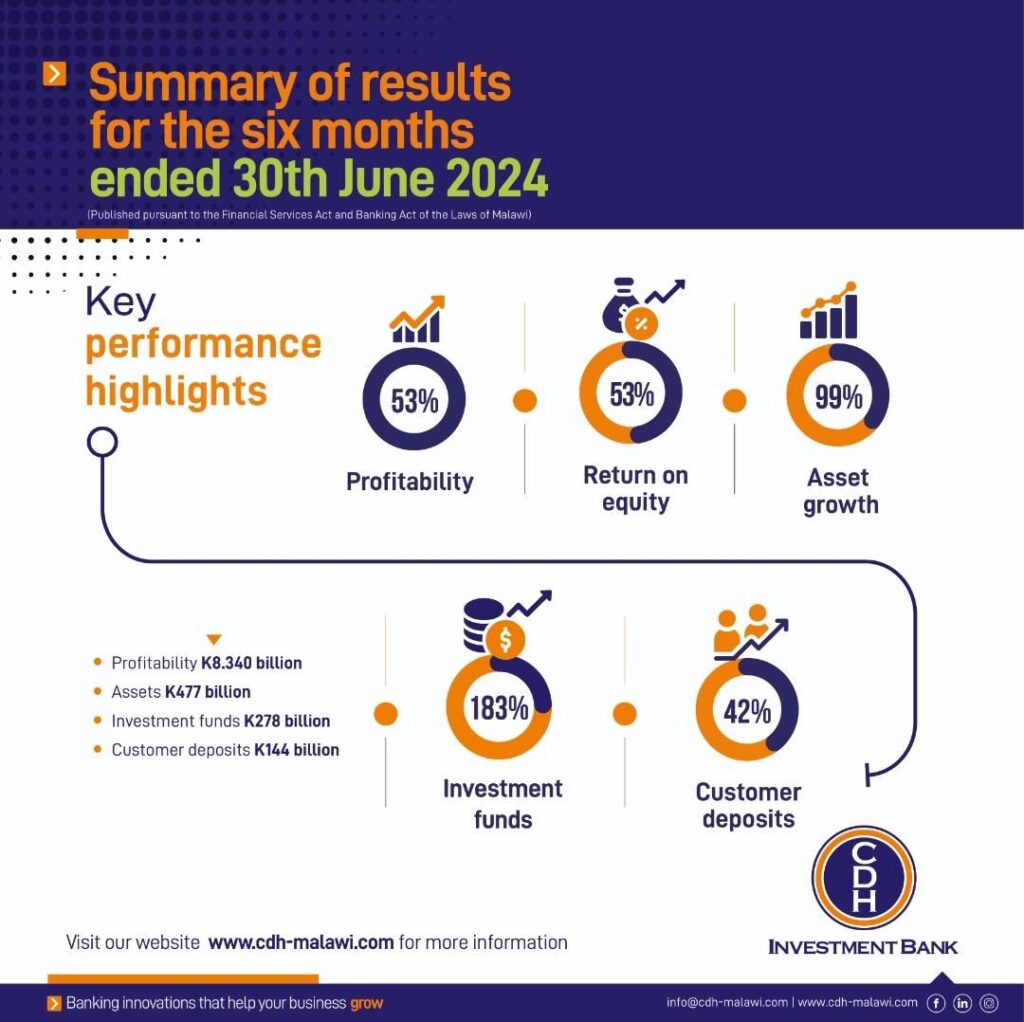

CDH Investment Bank has announced a profit after tax for the half year ended June 30,2024,of K8.3 billion, a 53% increase from the K5.5 billion reported in the same period last year.

According to the unaudited summary of results for six months released by the bank and endorsed by the bank’s Board Chairperson Franklin Kennedy, Chief Executive Officer/Managing Director, Thoko Mkavea, Chairperson of the Board Audit Committee Sydney Chikoti, and Chief Finance Officer,Kelvin Mkulichi, the results were driven by growth in both net interest income and non-interest income which grew by 53% percent and 26% percent respectively.

“The bank realised a profit after tax of K8.3 billion against prior half year performance of K5.5 billion representing an increase of 53%. Operating income before impairments on loans and advances grew from K12.9 billion to K20.7 billion mainly on account of growth in net interest income and non-interest income,” reads part of the statement.

It adds:”The bank’s performance in the first half of 2024 was driven by growth in investment funds and customer deposits.

“Total assets grew by 99% from K240.1 billion to K476.8 billion mainly due to a 180% increase in financial assets at fair value, a 91% growth in investment in government securities at amortised cost, and a 41% increase in loans and advances to customers.

“This was supported by a 183% growth in investment funds and a 42% increase in customer deposits. The bank continues to leverage on investment banking and advisory solutions to drive growth in its commercial banking business.

“Inflation is expected to remain high averaging 33.5% to the end of the year. Average headline inflation is estimated at 30.0% for 2024, higher than the average of 28.8% for 2023. Relatively high money supply growth, underperformance of the export sector and higher global oil prices are major risks to the inflation outlook.

“The bank expects continued pressure on the Kwacha exchange rate as a result of the increasing negative trade balance. The Malawi gross domestic product (GDP) growth is projected to average around 2.3% in 2024 mainly driven by the effects of El Nino weather conditions.”

“The leading investment bank in Malawi continues to successfully leverage on its unique ability to integrate corporate finance and investment banking services with traditional commercial banking activities to deliver impressive value to its stakeholders, generating an impressive return on shareholder’s equity.”

The report further reads: “We will continue to meet our client’s expectations through continuous development of our people, investment in modern technology, and investment in strategic alliances. We reaffirm our commitment to providing well researched and innovative financial solutions to all clients. Capital optimization, cost discipline, asset diversification and effective risk management will remain our pillars for sound financial performance for the bank.”

CDH Investment Bank is a leading investment bank in Malawi.

It opened for business on 2nd April 2012 following the successful conversion from Continental Discount House Limited which had operated in the financial sector for 14 years since August 1998.

CDH revolutionized trading of financial securities in Malawi, a legacy it continues to carry as it leads in the development of the capital market in Malawi.

The bank’s unique service proposition is investment banking and corporate financial advisory services to its clients.

It is a deposit-taking investment bank out of which it creates loans and advances.