By Linda Kwanjana

The battle for the control of Salima Sugar Company is this week expected to turn ugly with Indian shareholders refusing to pay auditors and while Government is set to unleash Fiscal Police to arrest Directors and former senior government officials under Democratic Progressive Party (DPP) regime over the chaos that has engulfed the company.

The company has been used as a cashcow for Indian investors and some government officials leaving Malawian taxpayer with debts close to K20 billion locally and over K130 billion internationally to settle for a packet of sugar that has not been sold on the street.

At the centre of controversy

Dozens of Indian businesses have been collecting sugar, including industrial sugar and have profited from it and some have never paid for the sugar or contracts, apart from inflated prices for equipment and services, milking the company dry.

The company has also been declaring loses, despite making billions of kwacha in hugely secretive sugar sales.

Eyebrows are being raised over the K623 million cost that Audit Consult is charging for a forensic audit which lasted for six weeks, making it K103 million kwacha per week, one of the most expensive audits in Malawi’s history.

Centre for Democracy and Development Initiatives (CEDEDI) has questioned the figures and demanded more details on the enormous amount being spent and its justification.

Looming arrests

Fiscal Police are this week are expected to obtain and execute warrant of arrests for all Indian Directors and some of the Managers- including the factory Manager who has since gone to India and some former DPP gurus over different cases at the company.

Those marked for arrests include former Finance Minister Joseph Mwanamvenkha, former Secretary to the President and Cabinet Llyod Muhara and former Inspector General of Police Duncan Mwapasa

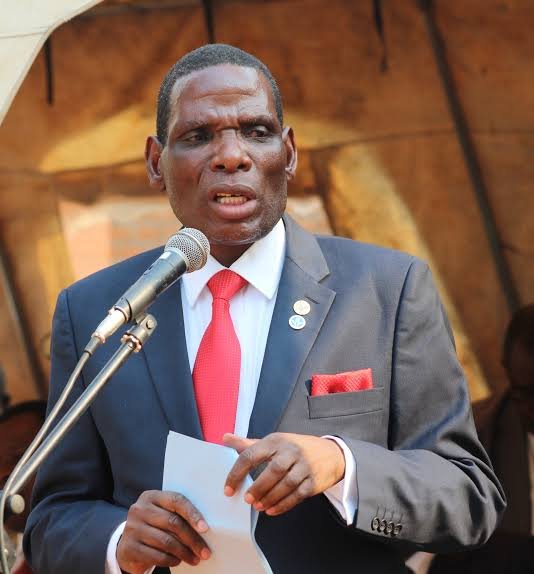

Former Finance Minister Joseph Mwanamvenkha on the blink of being arrested

Others include former National Oil Company of Malawi (NOCMA) officials, former Salima Sugar CEO Njoloma and unconfirmed individual who allegedly had contracts and obtained loans up to K300 million to set up sugar plantations.

Former Inspector General Mwapasa in a file photo with former President Peter Muthalika

“Police already got the files, but they did not find anything. These were commercial agreements they are supposed to deduct from the sugar cane supplied. Right now they have not paid most of the suppliers,” said one of the named officials, wondering how far will the mess at the company drag on.

All Indian directors and shareholders including former Executive Chairman and shareholder Shiriesh Betgiri who was already arrested before, are being accused of using the company to raise share capital and never contributing a cent from their own funds.

The Directors also paid themselves annual US$50,000 dollars as fees and all suppliers were a web of their own companies, family and friends.

Some of the suppliers and contractors who received Salima

Sugar and did not pay will also be arrested. We will publish the list of suppliers and contractors on Thursday.

The former shareholders registered another Salima Sugar in Dubai and wanted to use it to borrow loans up to US$300 million for the company they claimed was not making profits.

Government to propose new shareholding

Shareholders are set to meet on Wednesday 7 December 2023 to thrash the shareholding agreement to reduce the shares the Indian company owns to less than 15% after it transpired that K3.87 billion Betgiri had clamed to be share contribution came from battering Salima Sugar.

This means government could now raise its stakes to 80 % or more as the real value and monies borrowed and lost means the Indian partners have used most of the funds which was supposed to be pumped into the company.

The Forensic Audit on the company revealed that Directors forged and faked documentation and in some cases without full board approval attempted to obtain loans as high as K85 billion US$75 million and gave contracts to companies they owned or of friends.

We have been informed that warrant of arrests applications was being prepared to have all Salima Sugar directors, some of the managers and suppliers’ jails for a litany of criminal activities that has characterised the company since its inception.

The Financial Intelligence Agency (FIA) has been requested by the Centre for Democracy and Development Initiatives (CDEDI) to investigate the probable money laundering charges looking at the movement of billions of kwachas between companies and others.

The K623 million audit, K200 million bribe and Indian Directors don’t want to pay

Despite changing Executive Chairperson and some Directors, the Aum Sugar team which was running factory have remained signatories of bank accounts and in reaction to the forensic audit they have refused to pay the auditors and leaked the bill to the public.

“They first offered auditors K200 million to write a sweet report. The auditors refused. Now they want to pump up as a waste of resources to shield their skin. The battles in this company are very complicated,” our source claimed on Monday morning.

Our reporters could not verify the K200 million offer to Auditors as none of the parties answered our messages in relation to the matter.

CDEDI Executive Director Slyvester Namiwa asked Chairperson Wester Kosamu to inform the public the scope of work and also Betgiri how the company was expected to pay for an audit commissioned by government.

Kosamu refused to comment, saying “the public will be informed of any developments accordingly.”