By Chisomo Phiri

Yamikani Jimusole, a graduate gemologist and the Chief Executive Officer (CEO) of YAGLE, is advocating for the Ministry of Justice and the Ministry of Finance to expedite the resolution of the $309.6 billion claim against Nyala Mines Limited and Columbia Gemhouse.

This case, which involves allegations of unpaid royalties, taxes, and equity from 2008 to 2014, has the potential to significantly impact Malawi’s economy if properly handled. Jimusole, one of Malawi’s few accredited gemologists, has been researching and exploring the country’s gemstone industry for over a decade, focusing on understanding why Malawi remains impoverished despite its vast mineral wealth.

The $309.6 Billion Claim: A Closer Look

In 2022, the Office of the Attorney General of Malawi sent a demand letter to Eric Braunwart, President of Columbia Gemhouse, claiming that the company, in partnership with Nyala Mines Limited, owed the Malawian government $309.6 billion. This figure allegedly represents unpaid royalties, taxes, and the government’s 10% equity stake in the company from 2008 to 2014.

The claim was based on a report authored by W.E. Chaluluka in November 2014, titled “The Story of Mineral Wealth Exploitation in Malawi.”

The report suggests that Nyala Mines Limited generated an average of $51.6 billion annually during this period, yet only paid MK604,413 to the Malawi Revenue Authority (MRA).

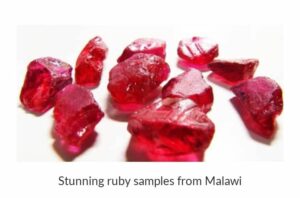

According to the report, the total export of 12,195,000 carats of ruby, sapphire, and padparadscha gemstones to the USA during this period should have resulted in a taxable amount of $309.6 billion.

However, Jimusole believes this claim is exaggerated and was calculated without considering key factors such as operational expenses, the actual quality of the gemstones, and the significant weight loss during the processing of rough stones, which can reach up to 65%.

He argues that the calculations assume a uniform quality and retail price for all exported gemstones, an assumption that is unrealistic given the varying grades and sizes of gemstones.

The Importance of Expert

Involvement:

Jimusole is confident that Malawi has a strong case against Nyala Mines and Columbia Gemhouse, but he emphasizes the need for expert involvement to ensure the accuracy and legitimacy of the government’s claims.

As an accredited gemologist, Jimusole has conducted extensive research on the Chimwadzulu mine, the source of the gemstones in question.

This mine, located in Ntcheu, is one of Africa’s oldest ruby deposits, dating back to the 1920s, and also produces over 16 types of sapphires, including the rare padparadscha.

Given his expertise, Jimusole advocates for the government to engage accredited gemologists and other industry experts to thoroughly review the financial records and assumptions made in Chaluluka’s report.

He also suggests that the audit of Nyala Mines should be extended beyond 2014 to include the years up to 2017 when the mine was under different ownership and from 2017 to 2024 under Mwalawanga Mining Limited’s management.

This comprehensive audit would provide a more accurate picture of the financial activities related to the mine and help validate or refute the $309.6 billion claim.

International Support and Industry Potential:

In addition to involving local experts, Jimusole recommends that the Malawi government seek assistance from international trade associations such as CIBJO (The World Jewellery Confederation), ICA (International Colored Gemstone Association), RJC (Responsible Jewellery Council), and AGTA (American Gem Trade Association).

These organizations, to which Columbia Gemhouse is a member, have the expertise and global perspective needed to help resolve the case fairly and transparently.

Jimusole also sees immense untapped potential in Malawi’s gemstone industry.

He believes that with the proper grading, certification, and appraisal systems in place, the industry could generate over $1 billion annually.

However, he points out that Malawi civil service commission currently has only one accredited gemologist and no accredited jewelry appraisers, a significant limitation that hinders the industry’s growth. By investing in the development of these systems and training more professionals, Malawi could significantly increase its revenue from gemstone exports.

The Need for Government Prioritization:

Despite the potential financial windfall from the case, Jimusole is concerned that the Ministry of Finance, which initially prepared the $309.6 billion claim, has failed to provide adequate funding to pursue the case.

The Office of the Attorney General has reportedly secured $4.5 million in funding from undisclosed sources, but Jimusole argues that the government should have prioritized this case within its own budget, which currently stands at over $5 billion.

He questions why external funding is necessary for a case of this magnitude, especially given the potential economic benefits if the claim is successful.

Jimusole urges the government to allocate the necessary resources to ensure the case is handled with the seriousness and expertise it deserves.

He also advocates for greater collaboration between the Ministry of Justice, the Ministry of Finance, and the Ministry of Mining to bring together the legal, financial, and technical expertise needed to win the case.

“Imagine if Malawi could recover just $5 billion of this claim.

“The overall impact on the economy would be transformative, providing much-needed funds for infrastructure, healthcare, education, and other critical areas, as well as a significant injection of foreign currency,” says Jimusole.

Jimusole also mentioned that he has sent letters to Reserve Bank Governor Dr. Wilson Banda and Secretary to the Treasury Dr. Betchani Tchereni to voice his concerns about the status of the gemstone industry in Malawi.

However, he has yet to receive any feedback on these critical matters.

Conclusion:

Yamikani Jimusole’s call for action highlights the need for a more strategic and expert-driven approach to the $309.6 billion claim against Nyala Mines and Columbia Gemhouse.

By involving accredited gemologists, extending the audit period, and seeking international support, the Malawi government can strengthen its case and potentially secure a significant financial settlement. Moreover, by investing in the development of Malawi’s gemstone industry, the government can unlock a new revenue stream that could contribute to the country’s economic growth.

Jimusole’s advocacy underscores the importance of transparency, accountability, and expertise in managing Malawi’s mineral resources.

With the right approach, the ongoing legal proceedings could not only result in a fair resolution of the Nyala Mines case but also pave the way for a more prosperous future for Malawi’s gemstone industry.